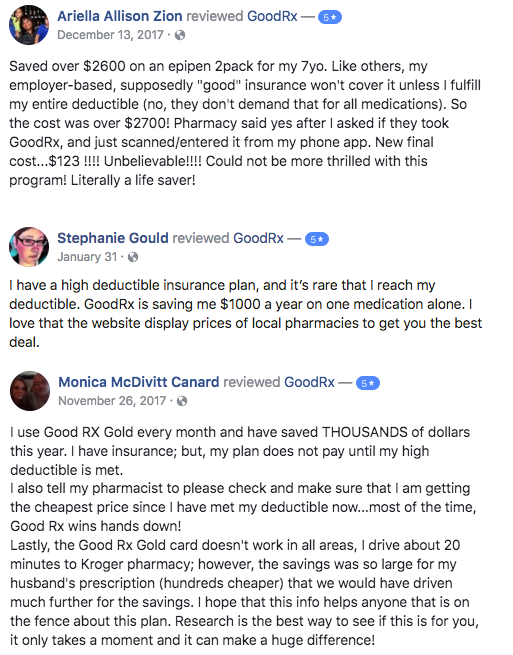

Recently, we’ve been noticing GoodRx users sharing their stories of high deductibles with us online.

So what’s going on? Sometimes, having a high-deductible health plan (HDHP) makes sense, like when you’re planning on having an expensive procedure that will help you reach the deductible (provided that you have enough saved to pay for it in the first place). An HDHP is also a good option if you’re pretty healthy and don’t typically have any medical expenses throughout the year. Most HDHPs come with lower monthly premiums, so in this case, you’ll be paying much less than traditional co-pay plans overall.

The reality is, though, that Americans have less and less say over what sort of health insurance they can get through their employers. Many employers will now only provide one health insurance option – an HDHP. According to the CDC, 39.3% of adults with employment-based insurance in 2016 had HDHPs, up a whopping 13% in 2011.

The consequences of being stuck with an HDHP you can’t afford is obvious. You’re responsible for footing all your medical expenses yourself until you reach that high deductible (usually at least $1,300/year for yourself and $2,600/year for your family) – and so you don’t. In 2016, 4.2% more people on HDHPs than traditional plans said they had a harder time paying medical bills on time, and 4% more people on HDHPs decided against or delayed medical care, including getting their prescriptions filled, due to cost.

As Monica says above, always do your research when you’re unsure of your health insurance plan and whether you’re getting the best bang for your buck. GoodRx can often help you save money when the price of your medications is too costly with your insurance. You can compare GoodRx prices on our website or with our mobile app.

Have a similar story? Let us know on our Facebook page or tweet at us!