A new drug comes onto the market, promising better results and a better patient experience – but at a much higher price than the existing generic drug. What happens next?

It’s a great question. Amid national outrage over the cost of drugs, sometimes new, more expensive drugs actually do bring real benefits. But those benefits come with the tradeoff of higher costs, both for patients and for the system at large. So how do these tradeoffs play out in the real world? And when and where do doctors decide to use one medication over another? We decided to dig into the data for an answer.

We had a great test case in oral anticoagulants, a type of drug often prescribed to individuals at risk of blood clots, such as after surgery, or those with atrial fibrillation. For about the past 60 years, the standard drug for this purpose has been warfarin, marketed under the brand name Coumadin and the generic brand name Jantoven. Warfarin is a vitamin K antagonist, and works pretty well for its intended purpose. It is also relatively affordable, with an average cash price around $20 for a 30 day prescription.

Recently, a new group of drugs have emerged for the same purpose, known as novel oral anticoagulants, or NOACs. NOACs offer several advantages to warfarin: They require less physician monitoring (Warfarin requires daily physician check-ins in the first week, and frequently thereafter), thus saving the doctor time, saving the patient hassle, and saving insurers the cost of so many follow-up visits. Warfarin use also requires some dietary restrictions which are not necessary with NOACs. All this plus similar or better outcomes as warfarin.

These new drugs are Pradaxa (dabigatran), Xarelto (rivaroxaban), Eliquis (apixaban) and Savaysa (edoxaban). Pradaxa was the first NOAC approved by the FDA in 2010, with the others reaching the market soon after. But: The new anticoagulants are significantly more expensive, with the cash price up to $470 for a 30 day prescription (Pradaxa costs $448; Xarelto, $470; Eliquis, $463, and Savayasa, $375)

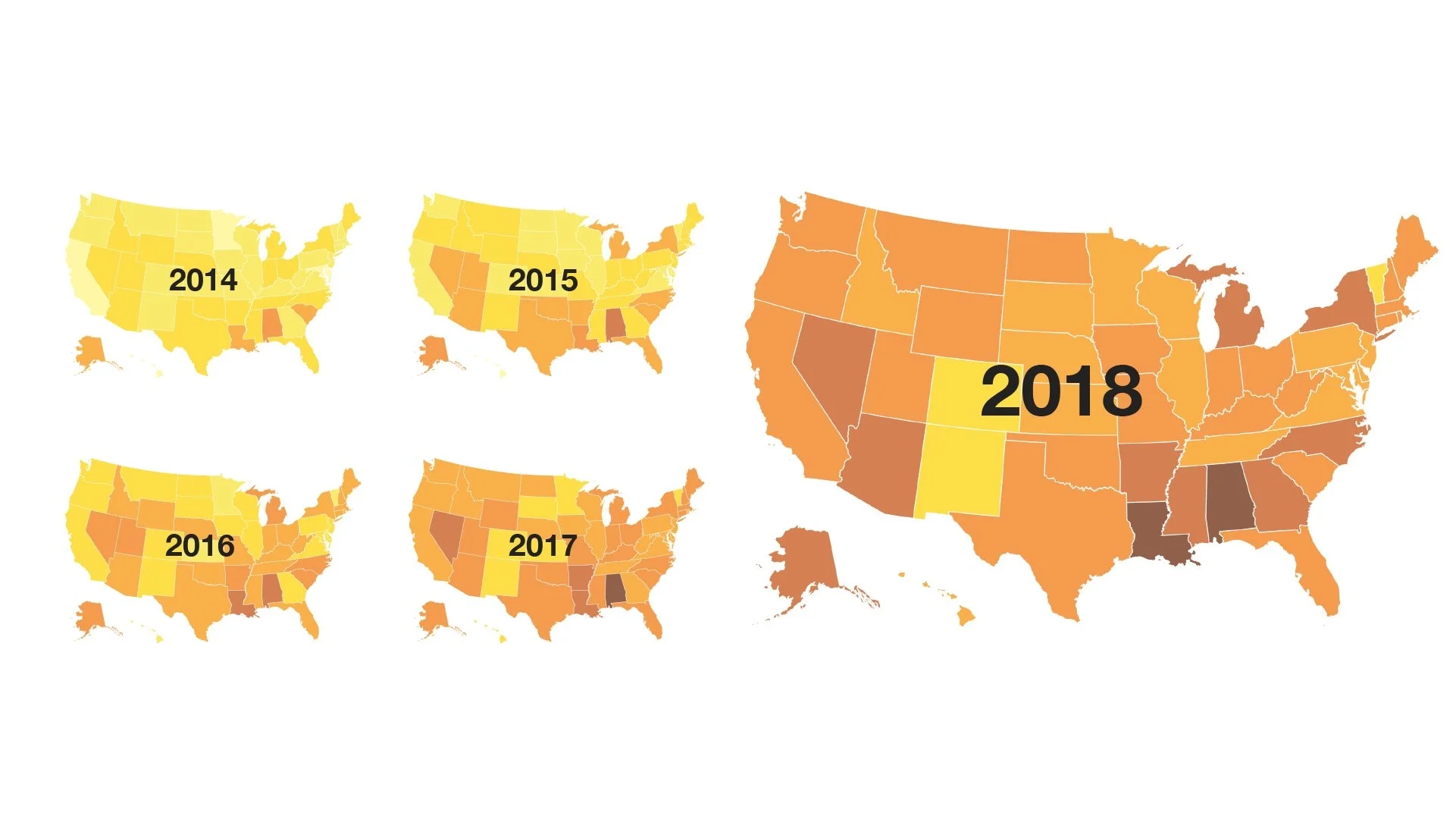

So what’s happened since the new drugs reached the market? A clear and steady switch in prescriptions, with warfarin being prescribed less and less often, and the NOACs being prescribed more and more often. Since 2012, in fact, the overall market share of NOACs has increased from less than 10% to nearly 50% of all prescriptions of oral anticoagulants today.

Market share of NOACs in the United States

| Year | Market share of NOACs |

| 2012 | 9% |

| 2013 | 13% |

| 2014 | 20% |

| 2015 | 26% |

| 2016 | 34% |

| 2017 | 42% |

| 2018 | 47% |

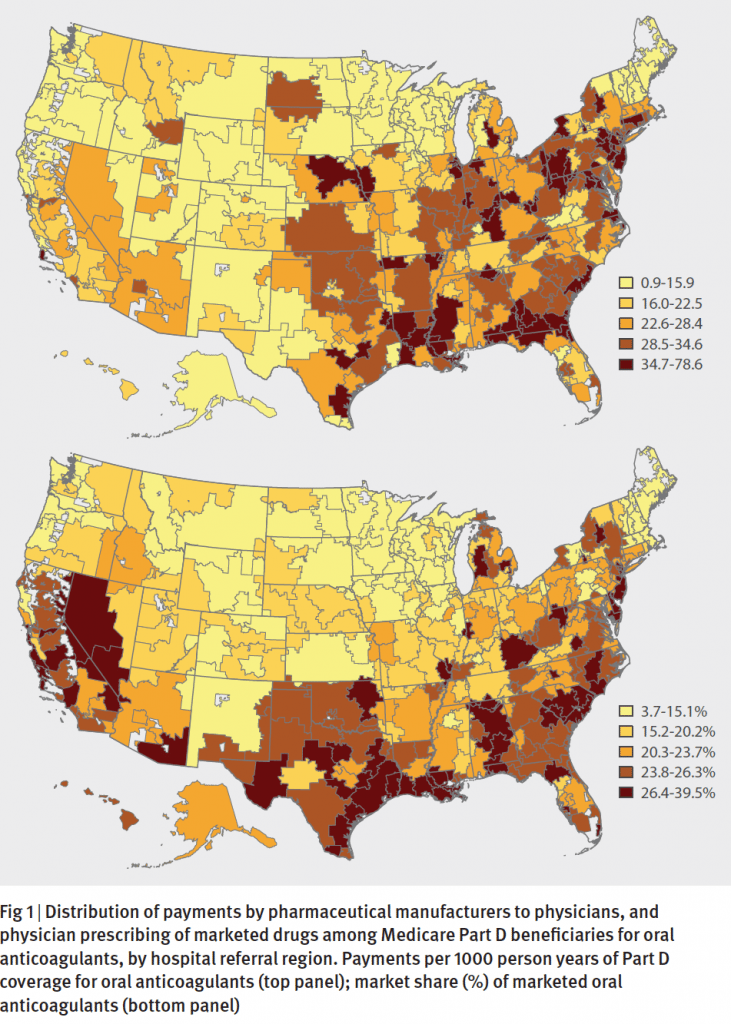

But that surge doesn’t tell the whole story. A GoodRx analysis of national drug fill data, looking at the number of prescriptions by state, reveals a clear geographic dimension to the use of the new medications. In some states, such as Alabama, Arkansas, Louisiana and Nevada, the market share for NOACs exceeds 60%, while in other states, such as Colorado, New Mexico and Vermont, warfarin is still the most commonly used drug, with NOACs prescribed just 30% of the time.

The pattern bears similarities to findings from a 2014 BMJ research paper where the authors analyzed Medicare part D prescription data, along with payments to physicians by the manufacturers of these new drugs. The analysis, written by a team of medicine and economics researchers from Yale University, found that, sure enough, the uptake of new drugs tracked with the payments to physicians. In states like Louisiana, Alabama and Nevada where payments to physicians were higher, the share of brand drugs was high too. The association was statistically significant, suggesting that the payments had the effect of increasing prescriptions of the new drugs.

To be sure, the uptake of new brand name medications is influenced by a number of factors, including the price of the drug, whether insurance companies include a new drug on their formulary lists of covered medications, knowledge among prescribers about the benefits, and whether patients themselves know about new alternatives. And it’s understandable that drug manufacturers, having spent millions of dollars to research and develop a new medication, would engage with all stakeholders to increase awareness of their drugs, including direct marketing to consumers and engagement with providers.

Read more like this

Explore these related articles, suggested for readers like you.

And the new drugs do provide real benefit to real people, as well as potential savings to the system. Innovation in the prescription drug market can help improve health outcomes. New drugs can actually help lower costs in the health care system for example by prevention hospitalization, or improving the management of chronically ill patients.

However, there are some real costs, as well. The new drugs do not always get treated the same by insurance companies, leading to confusion among prescribers and patients alike in trying to find a medication that’s better AND covered by insurance. And even then, patients often end up bearing a larger share of the burden of paying for the drugs, through higher co-pays or co-insurance.

After all, even the best medicine has to be something that patients can afford.

In this case, it’s striking to see the change happen, and how the market adjusts with these tradeoffs in real time.

Why trust our experts?