Despite continuous pushback from Congress, the Trump administration, and the public, drug list prices rose again this January. In total, over 100 manufacturers raised the price for 619 brand drugs by an average of 5.2%.

So why the increases? And how much will higher prices strain consumers’ pocketbooks?

January price bumps are an annual tradition

These yearly January price hikes are not new. Since 2014, we have been seeing a jump in the GoodRx List Price Index at the beginning of every year, signaling pharma’s yearly price increases. In January 2018, we saw the biggest bout of increases, with 729 brand drugs increasing by an average of 7.7%. In 2019, 601 brand drugs increased by an average of 5.8%.

Hover over the graph to track drug increases for 2018, 2019, and 2020.

While it doesn’t seem like January price hikes are going away anytime soon, the timing of these price hikes has seen some changes over the years. In 2018, almost 90% of all price increases happened during the first week of January. In 2019 and 2020, on the other hand, prices steadily increased over the entire month.

Why is this happening? Media, the government, and the public are well aware of January hikes, and the new year is typically shrouded with coverage calling manufactures out on their pricing tactics. However, as January passes, the coverage dies down, and manufacturers are able to increase prices relatively under the radar.

Which drugs saw price increases this January?

From December 31, 2019 to January 31, 2020, over 100 manufacturers raised the list price of their drugs, and many of these drugs have seen increases in past years. What’s more, blockbuster drugs and those that top the GoodRx Most Expensive Drug list weren’t safe from increases.

Both Myalept and Juxtapid are among the most expensive drugs in the U.S., with list prices topping $44,000 per month. But despite their heavy price tag, prices only continue to climb. For the past 3 years, both Juxtapid and Myalept have increased by 9.9%, totaling almost 30%.

Humira, the blockbuster rheumatoid arthritis treatment, has also seen increases during January over the past 3 years. In January 2018, 2019, and 2020, Humira increased by 9.7%, 6.2%, and 7.4%, respectively.

Read more like this

Explore these related articles, suggested for readers like you.

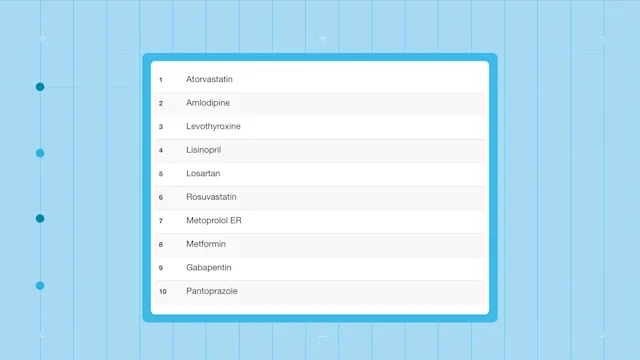

The following are some of the more popular brand drugs that saw price increases this year. You can see the full list of brand drug price increases here.

Two common numbers: 9.9% and 5%

In 2018, amid pressure from the government and the public, manufacturers pledged to keep their price increases below 10%. It’s clear that manufacturers are sticking to that pledge, but barely. Since 2018, yearly price increases for many drugs have averaged around 9.9%, only a smidge below 10%.

Manufacturers have 2 ways of achieving this 9.9% increase: 1) they increase the price of their drug by around 9.9% in January, or 2) increase the price by around 5% twice a year in January and July. These pricing tactics are common, and they explain why many drugs saw increases around 9.9% or 5% this January. It’s likely that drugs like Yaz and Restasis that saw 5% increases in January will see another bump in July.

Luckily, only 2 drugs saw an increase above 10% this year. Marplan and Cotempla XR, both brand-only drugs, increased by 14.9% and 12.3%, respectively.

Do list price increases affect consumers?

In short, yes. While few people actually pay the full list price of a drug (the official price of a drug set by the manufacturer), it is a powerful indicator of drug pricing trends. List price increases end up trickling down to all consumers for multiple reasons.

For one, higher list prices typically translate into higher cash prices at the pharmacy. A cash price is what a patient pays at the pharmacy without insurance or any discounts. Think of a drug’s cash price like the “sticker price” of a car. While cash prices vary from pharmacy to pharmacy, they are highly affected by the list price of a drug.

So what about those who have insurance — are they affected by list price increases? Unfortunately, yes. List price increases typically trickle down to patients in the form of higher out-of-pocket costs like premiums, co-pays, and/or coinsurance. When a manufacturer raises the price of a medication, the insurance provider likely has to pay more for that drug. They can make up the cost by raising premiums, increasing co-pays, or placing the drug on a higher tier in insurance plans (which means the patient ends up paying more out of pocket for it).

—

For more information, contact press@goodrx.com.

Co-contributors: Amanda Nguyen, PhD, and Sara Kim, MS

Methodology

All of these prices are based on the list price — the price of a drug that is set by the manufacturer. Few patients actually pay this price because they are typically shielded by their health insurance. But the list price is still a good proxy for the price of a drug. In essence, rising list prices lead to rising out-of-pocket costs for patients.

This analysis tracks all drugs in our list price index as of December 31, 2019, excluding over-the-counter drugs and drugs administered by health care practitioners. It represents the drugs that are typically dispensed at a retail pharmacy.

The list of most commonly prescribed drugs with an effective price increase is based on a nationally representative dataset of prescription drug claims. It excludes brand-name drugs that have a generic equivalent.

Why trust our experts?