Key takeaways:

To curb rising healthcare costs, California and Massachusetts passed laws limiting the use of copay savings programs for brand-name drugs.

Compared to all other states, California and Massachusetts both have lower market share for the seven brand drugs we looked at. So these policies may be working. But there is still more to be done.

Drug manufacturers offer copay savings programs to help patients afford out-of-pocket costs for prescription medications. However, employers, commercial insurers, and some government officials argue these programs hurt patients in the long run because they can drive up healthcare costs overall.

Their argument goes something like this: Even though these programs offer out-of-pocket savings to the patient, the amount paid by the patient’s insurance doesn’t change. This leaves insurance companies on the hook for the price of the drug. These programs also steer patients toward brand drugs when a lower-cost generic alternative may be available. Both of these factors combined can lead to higher costs for insurers, which are passed on to patients in the form of higher copayments and premiums.

In an effort to curb rising costs, California, in 2017, and Massachusetts, in 2012, both passed legislation limiting the use of these savings programs. Specifically, the legislation restricts the use of copay savings programs for any prescription drugs that have an approved generic equivalent as determined by the FDA. This is intended to keep patients from filling prescriptions for expensive brand drugs that have a less expensive generic equivalent available.

The GoodRx Research Team decided to examine how these laws have affected the use of copay programs in California and Massachusetts.

Are these policies effective?

The policies described above are supposed to steer patients toward more affordable generics instead of having them relying on copay savings programs to cover the cost of an expensive brand counterpart. So, if the policies are working as intended, we would expect to see a smaller market share for brand drugs that have both a copay savings program and a generic counterpart.

To investigate whether the laws in California and Massachusetts are working, we compared the market share for seven popular brand drugs that have a generic available and a copay savings program.

What we found

Overall, brand market share for the seven drugs is lowest in California, at 7.48%, followed by Massachusetts at 9.94%. All other states are at 12.29%. This data shows that for the drugs we investigated, fewer people are filling for the brand in California and Massachusetts compared to other states.

We also looked at fill rates for the seven generic counterparts in California and Massachusetts. Overall, Massachusetts has the highest fill rate for the generic medications, at 2.92%, followed by all other states at 2.60% California has the lowest generic fill rate at 1.75%. The results indicate that the percentage of fills for the generics of the seven brand drugs was lowest in California and highest in Massachusetts.

Another thing to note is that five out of the seven drugs have a generic that has a cash price over $100. If patients in California and Massachusetts can’t use copay savings programs for the brand drug (and five out of the seven drugs have a 40% or greater savings off the brand cash price) this leaves the generic as the only option. However, since most of the generic cash prices are fairly expensive, some people may not be able to afford the generics for most of these drugs.

California’s program: the verdict

California’s lower market share for brand drugs in comparison to all other states could mean that the restriction policy is working to steer patients away from expensive brand drugs. However, California also has a low fill rate for the generic counterparts. So California’s policy restricting copay savings programs for brand drugs could be pricing some patients out of the market for their medication. If patients can’t afford the brand drug without a copay savings program and the generic is also expensive, patients may be forgoing the treatment altogether.

Read more like this

Explore these related articles, suggested for readers like you.

Massachusetts’ program: the verdict

Massachusetts also has a lower market share for the seven brand drugs relative to all other states (except California). This could mean that the policy in Massachusetts is working to lower the amount of patients filling prescriptions for brand drugs.

Additionally, Massachusetts has the highest fill rate for generics of these brand drugs, which is another sign that the policy in Massachusetts could be working. Patients are foregoing expensive brand drugs because they can’t use copay savings programs and receive the discounted price. In response, they could be filling the available generics despite the high prices of some of them.

Keep in mind, however, that our conclusions are based on the statistics alone and do not provide conclusive evidence on whether the policies are working.

Summing it all up

Research shows that these policies are likely working, as they are reducing the use of expensive drugs. However, maybe they’re not working as well as they could be. If these policies were working as intended, we would more than likely see even lower brand market share in California and Massachusetts compared to all other states. On top of that, the generic market share among California, Massachusetts, and other states does not differ substantially, so the hope for a sizable increase in generic fills is not being seen yet.

In California and Massachusetts, patients aren’t allowed to use a copay savings program for a brand drug, so their cheapest option is to fill for its generic instead. However, five out of the seven drugs we looked at have a generic with a cash price over $100. These high generic prices could make them unaffordable for patients who have to pay out of pocket for their generic medication.

The Massachusetts Health Policy Commission recognized this in their recent report investigating manufacturer copay savings programs. They indicated that there are brand drugs where a generic equivalent is set at a high price, and patients with high cost-sharing or deductibles may find the generic unaffordable.

The impact of these policies may also depend on factors other than the actual legislation. Beyond the high price of generics, another issue could simply be insurance coverage, since coverage options vary state to state. Those without insurance and with high-cost insurance could find both the brand and generic too expensive to fill. Not to mention that physicians’ prescribing patterns for these conditions can vary and could be a reason for brand share and fill rate variability among states.

Despite these policies, brand drug prescriptions are still being filled even if there are generic equivalents available. Which means that restricting copay savings programs for brand drugs may not be the best answer for increasing generic use. As long as prices for brand and generic medications remain high, we will still see the use and demand for copay savings programs.

– – –

Co-contributor: Diane Li, Amanda Nguyen, PhD

Methodology

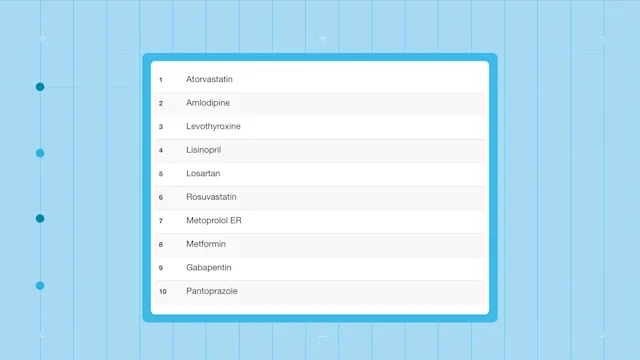

For our analysis, we first selected our cohort of drugs. We chose the most popular brand drugs in 2019 by ranking the top 200 drugs by claim count using a representative sample of U.S. prescription fills in 2019 (not GoodRx fills). We only kept brand drugs that had a generic available prior to 2019 and had a copay card. For the final analysis, we selected seven brand drugs. Additionally, for each brand drug, we also selected its generic drugs.

For our included drugs, we grouped the fills by the state where the prescription claim was filled. We additionally grouped the claims into three state groups: 1) California, 2) Massachusetts, and 3) all other states, so that we can compare fill patterns for states with and without copay card legislation.

Using the same representative sample of U.S prescription fills in 2019 mentioned prior, we:

Found the market share of included brand drugs relative to its generic by state group

Found the fill rate of all included generic drugs relative to all drugs by state group

Obtained the average national cash price for each drug

Why trust our experts?