Key takeaways:

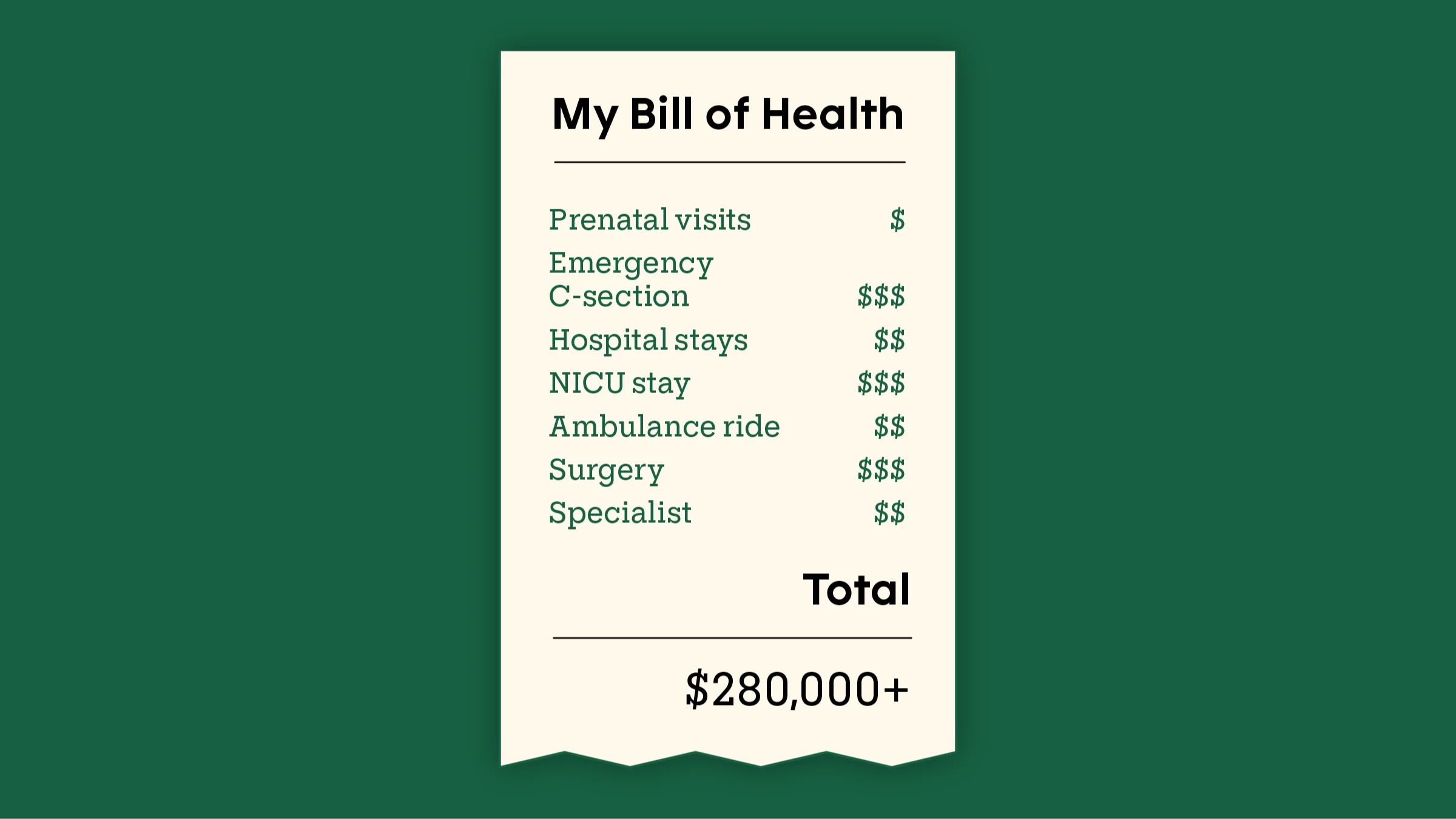

Emily Pierzina faces more than $280,000 in medical bills from her son’s traumatic birth.

Emily had two active health insurance policies at the time, but now neither is claiming responsibility as the primary insurer.

As her son nears his first birthday, Emily is still fighting with the insurers over a mounting pile of bills.

When Emily Pierzina found out she was pregnant, she never imagined that childbirth could cost her family hundreds of thousands of dollars.

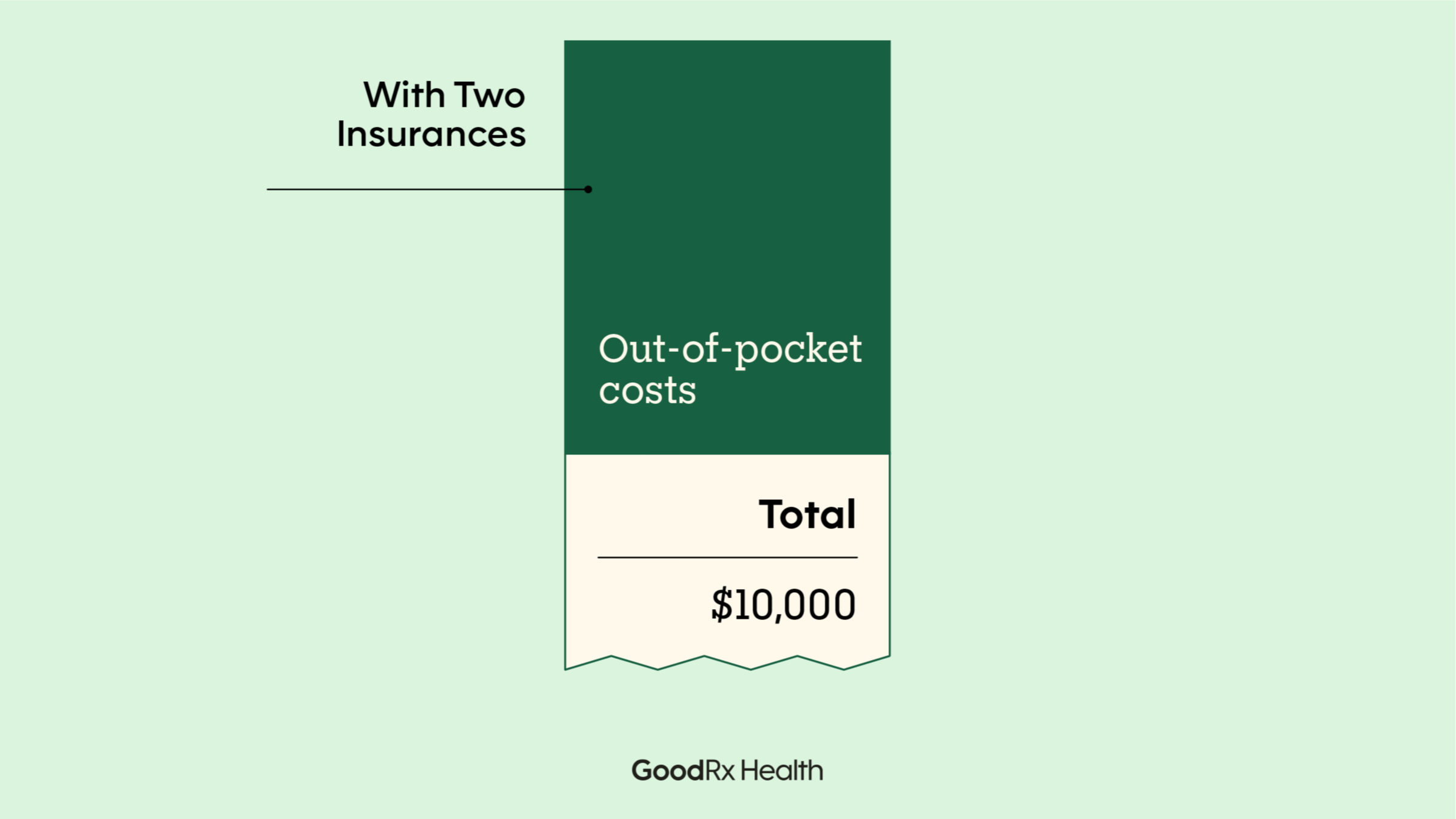

Emily had good health insurance coverage through her husband, on a plan that had competitive maximum out-of-pocket limits.

The most the Oregon family expected to pay in a calendar year for healthcare was roughly $4,750. That cap should have covered everything in 2022 — from Emily’s prenatal visits to her hospital stay for childbirth to her newborn’s pediatrician appointments.

“I thought everything was going to be fine,” Emily says, “especially because the pregnancy had been so easy. All my doctors and everything were in-network.”

And, as an added backup, Emily — who was 25 at the time — was also listed on her parents’ health insurance. Under the Affordable Care Act, adult children can stay on their parents’ insurance until the age of 26. In Emily’s case, this policy acted as a secondary insurance to cover any costs that her primary insurance wouldn’t.

Other than mild heartburn, Emily’s pregnancy was smooth and uneventful until the tail end. In the last few weeks, she began to develop high blood pressure, and her doctor advised an induction at 39 weeks.

A traumatic labor and delivery

When Emily was admitted to the hospital that July morning for the induction, “Everything started out OK,” she says. “I was dilating.”

That evening, she started having contractions and had trouble sleeping. She got an epidural the next day. But she remembers that something felt off.

“I kept complaining to the nurses and the doctor that ‘I’m in a lot of pain. My hips really hurt. Something’s wrong,’” she says. The care staff tried to reassure her. But Emily ended up needing an emergency Cesarean section (C-section).

Read more like this

Explore these related articles, suggested for readers like you.

Two days after she arrived at the hospital, her son Blake was born. But soon after his birth, Blake started having seizures. He was transferred to the neonatal intensive care unit (NICU) at a different hospital, where he spent 10 days in intensive care.

“They discovered he had a neonatal stroke because he was stuck in me for so long,” Emily says. “I knew something was wrong when his heart rate kept dropping. I asked [my doctor] that morning if we could just do a C-section and get him out.”

A mounting pile of medical bills

As Blake approaches his first birthday, his schedule includes a full rotation of appointments with specialists to address what doctors say is mild cerebral palsy caused by the stroke.

And for Emily, it means sorting through a mountain of medical bills.

Although Emily has two active health insurance policies — primary insurance through her husband, secondary insurance through her father — neither are currently agreeing to cover her expenses.

“My husband's insurance wasn’t wanting to play primary, so both insurances were running secondary,” she says. “I’m still fighting with them.”

And the bills keep coming in. $4,800 here. $2,300 there. $1,500 for Blake’s ambulance ride to the NICU.

The induction. The C-section. The hospital stay. An additional week in the hospital, round-the-clock IV antibiotics, and a second surgery after Emily’s internal incision became infected.

“I’ve gotten a couple bills in the mail that said neither [insurance] covered anything,” Emily says.

Without insurance, the total cost so far racks up to more than $280,000.

Based on conversations with the two insurance companies, Emily says she thinks she owes about $10,000 out-of-pocket for her care. But she’s not sure because not all of the healthcare costs have been processed through insurance yet. And the insurance companies still haven’t come to a final agreement over who is responsible for what.

“I’m still working with insurance in terms of making sure everything gets processed correctly,” she says. “We’re working out payment plans when we can and trying to pay down anything we can, as we can. But we’re kind of just making ends meet at this point.”

And it’s not just the financial burden.

“We’re jumping through hurdles making sure we have enough money for everything and then making sure we have the time cut out for [Blake’s] doctors’ appointments and physical therapy appointments,” she says. “I’m just taking it day by day.”

The eye-watering price tag of her traumatic childbirth experience only makes it harder to process.

“We never thought any of this could happen because he was such an easy pregnancy,” she says. “And to get charged so much for it, it’s like a knock when you’re down.”

Feeling let down by the healthcare system

Emily says she feels let down by the system.

“I just wish I could have advocated for him more, and for me,” she says, her voice breaking.

That’s the lesson she has taken away from her experience: “The best thing I can say is be very stubborn in advocating for yourself,” she says. “Because if you don't, you will just get walked all over.”

“Be very insistent. That is the only [thing] I’ve gotten out of all of this and probably my biggest regret.”

Resources for reducing medical debt

If you have medical bills you don’t know how to pay, you may be able to negotiate with your hospital’s billing office to reduce your medical costs.

If you're having trouble understanding your health insurance, figuring out what prices are fair, or dealing with medical bills, there are special organizations that can help. Here are some resources dedicated to helping people reduce their medical debt:

Why trust our experts?