Key takeaways:

Sharon Eriksen had a biking accident in 2021 that left her with medical debt she couldn’t pay.

She had no health insurance and didn’t have enough savings to cover the bills.

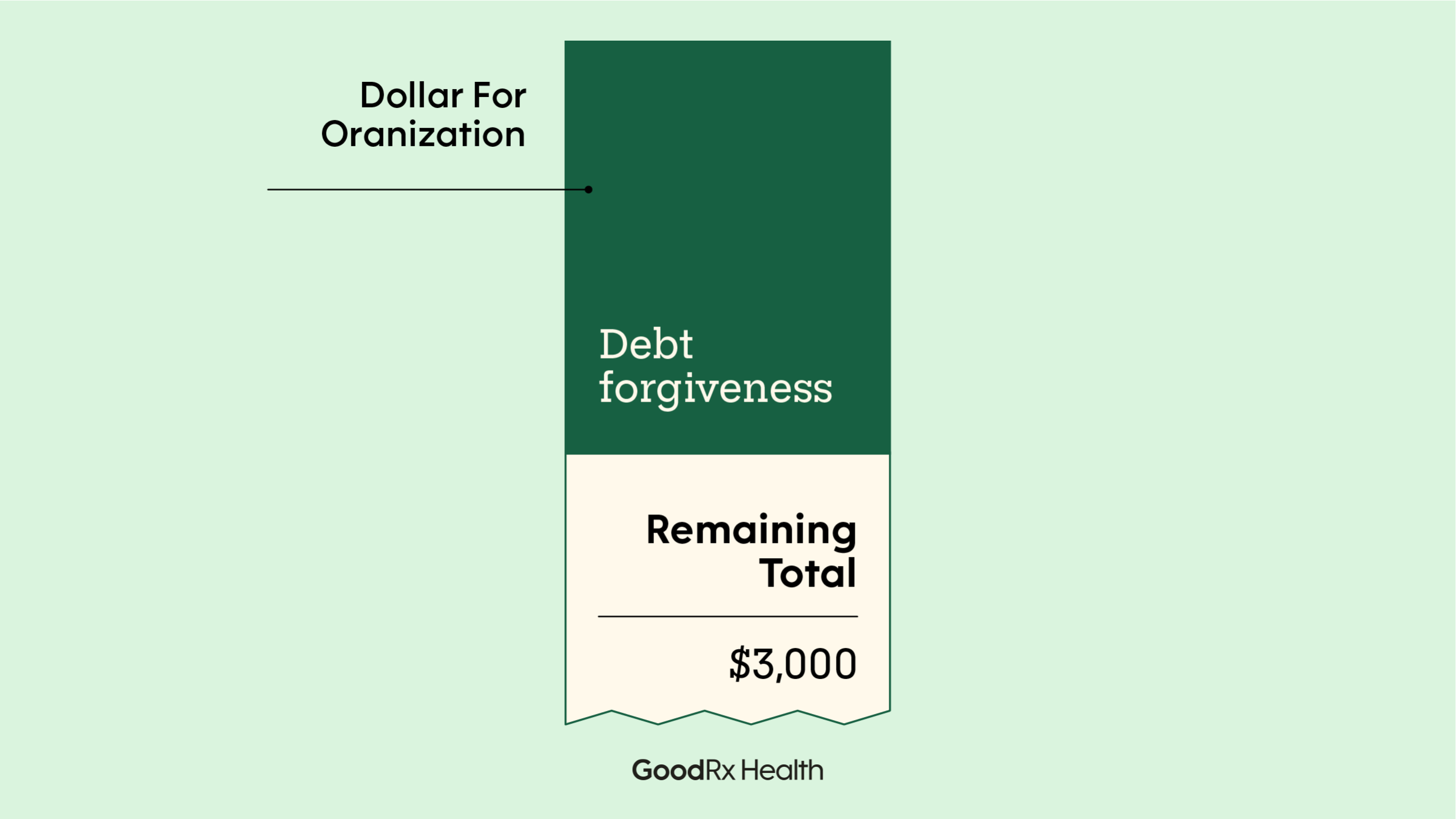

Sharon contacted an organization called Dollar For, which helped her clear more than six figures of medical debt.

A medical emergency can happen at any time without warning. And it can leave you with more medical debt than you know how to pay. In the U.S., more than 1 in 10 adults have medical debt, and an estimated 3 million owe more than $10,000.

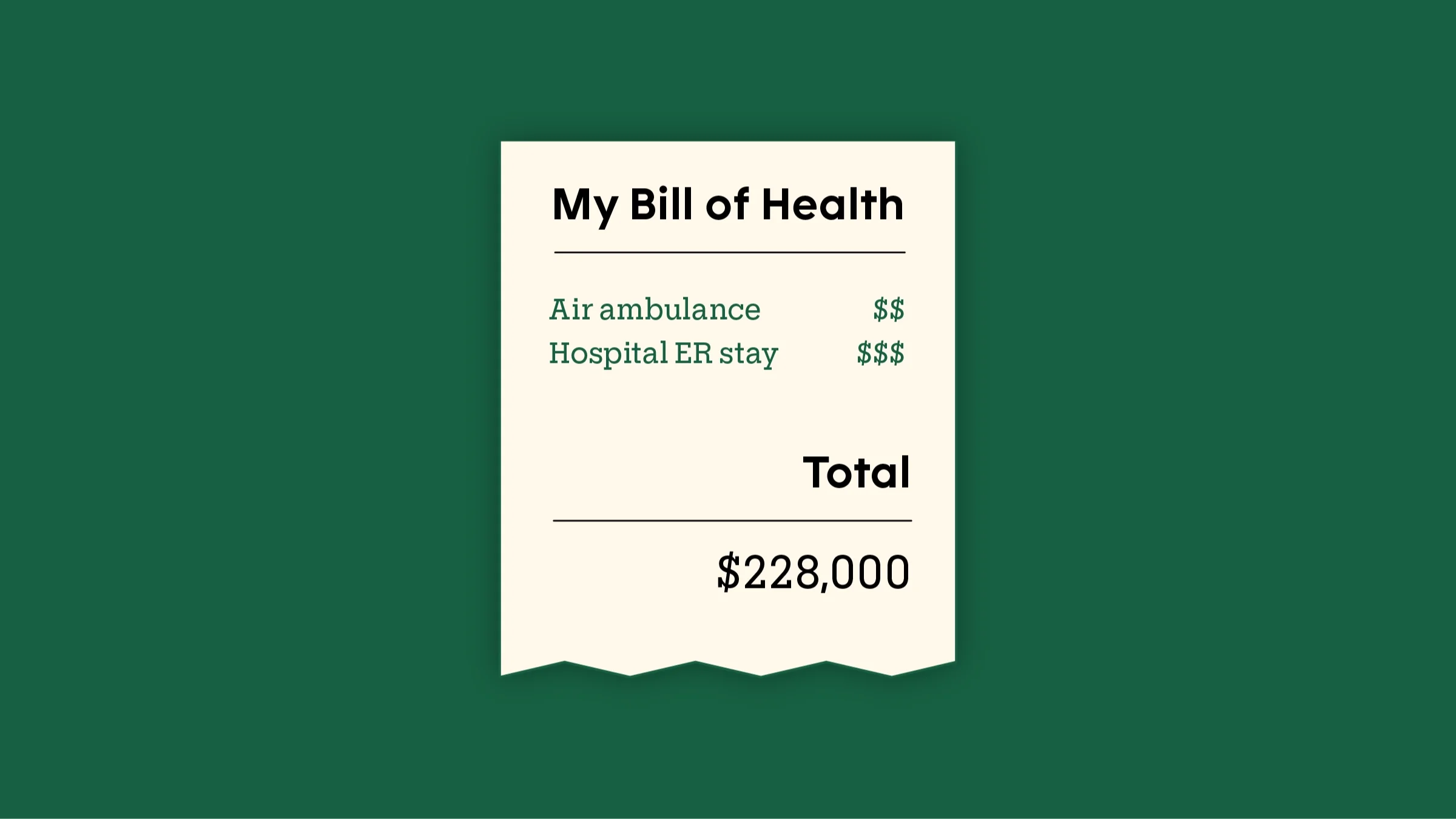

Sharon Eriksen was a summer seasonal park ranger at Yosemite National Park in California when her emergency left her with more than $228,000 in medical debt.

She was on her way home from a bike ride with friends in July 2021 when she suddenly fell off her bike and landed on the side of her face. She was unconscious until she woke up in the emergency room (ER) at Modesto Trauma Center, where she had been airlifted because of her head injury.

“The experience was nerve-racking,” Sharon says. “Because I remember riding my bike home from the beach. And the next moment, I’m in a bed surrounded by nurses telling me what happened.”

She underwent tests and scans. Doctors diagnosed her with a severe concussion and several facial fractures. Even though she didn’t need surgery, Sharon knew the air ambulance ride and her stay in the ER would cost her money she didn’t have.

Underwater in medical bills

Several weeks later, Sharon got her first medical bill in the mail.

“When the first bill arrived, I waited for weeks to open it because I knew it would be outrageous,” she says. “As a seasonal park ranger, I had no medical benefits. So, I had to pay for everything out of pocket.”

That first bill was from the air ambulance company. It amounted to $68,100. In the next few weeks, more bills piled up. Sharon found a second job to slowly chip away at them. She also began looking for more viable options to pay the medical debt.

Recovery included physical and emotional pain

In addition to stressing over how to pay her bills, Sharon was still recovering from her accident. She says her pain was physical and emotional. She remembers going from being fine one day to being unable to walk the next. The hardest changes for her, she says, were the healing process and being unable to work.

Read more like this

Explore these related articles, suggested for readers like you.

“I didn’t recognize myself when I first looked in the mirror,’” she says. “I was scared because I couldn’t be a park ranger with these injuries and would have no income.”

Researching bankruptcy and medical debt forgiveness

Sharon first looked at medical debt bankruptcy and debt forgiveness options before a friend sent her a National Public Radio story on Dollar For. After contacting the nonprofit on Instagram and filling out a short questionnaire, Sharon found out she was eligible for financial assistance. She matched with a patient advocate who walked her through the process of contacting the hospital to lower her medical bills.

“I didn’t know you could negotiate medical bills before I found Dollar For,” Sharon says. “And this was the first medical emergency in my life. They guided me throughout the process and advocated for me when no one else would.”

With negotiating and financial assistance, her medical bill for an 8-hour ER visit went from $160,000 down to $3,000. And her air ambulance bill of $68,100 was completely forgiven.

“Not having medical debt hang over me as my sole focus brought me peace to move forward with my life,” Sharon says.

Getting out of debt felt like winning the lottery

Since her accident, Sharon has switched careers and become a clerical secretary to give herself stability and health insurance. She still lives in Yosemite and enjoys going on hikes during her free time. She hopes her story can help others find resources for reducing their medical debt.

“Getting out of this medical debt made me feel like I won the lottery,” Sharon says. “And going forward, I want to focus on enjoying my life and connecting friends and family with these resources.”

Sharon Eriksen told GoodRx her story as part of a partnership with Dollar For, a nonprofit that helps people reduce their medical debt.

Why trust our experts?